There is a tide in the affairs of men,

Which, taken at the flood, leads on to fortune

Which, taken at the flood, leads on to fortune

Ah, Istanbul.

I'm back at home, hangin' wit da Double B, and have posted a few pics from our recent travels. Due in large part to Ace's prolific photography, I have over 400 pics on my hard drive, so we will arrange to post some of them up on a server once he is back. We will email you the link at that time.

I'm back at home, hangin' wit da Double B, and have posted a few pics from our recent travels. Due in large part to Ace's prolific photography, I have over 400 pics on my hard drive, so we will arrange to post some of them up on a server once he is back. We will email you the link at that time.

Today, the cloud ceiling was far lower than last Saturday when we flew into Tibet, and this time I specifically asked for a window seat on the starboard side of the plane. Therefore, at an altitude of about 30,000 feet, I could enjoy a clear view of the breathtaking Himalayan panorama. As the pilot bore us south to cross the mountains, I could easily see the foreboding north ridge of Everest, with Cho Oyu just behind to the west.

Then, we made a 90º turn to the right, around Lhotse and Makalu, so our new heading afforded a beautiful view of Everest's famous South Col, and the more conventional route to the summit. Beyond, I could just make out the Annapurna range, with various other Himalayan peaks in between.

I am now prepared to take up Faceman's years-old challenge to trek up to base camp. Name your time, buddy, and I'll be there.

Then, we made a 90º turn to the right, around Lhotse and Makalu, so our new heading afforded a beautiful view of Everest's famous South Col, and the more conventional route to the summit. Beyond, I could just make out the Annapurna range, with various other Himalayan peaks in between.

I am now prepared to take up Faceman's years-old challenge to trek up to base camp. Name your time, buddy, and I'll be there.

24 hours ago, I was at 4,500 m (14,760 feet) at the Ganden monastery, which clings precariously to a hillside above the Lhasa valley, surrounded by yaks and very little else. A miraculously clear day offered us breathtaking views of the surrounding hills, a couple of snow-capped peaks, and the distant valley bellow.

Now, I'm ensconced in comfort at the Kathamandu Guest House, where I have Western newspapers, puri and bateta, and a quiet courtyard in which to enjoy these treasures. It was nice to arrive at the airport and unexpectedly meet our travel man Kul, who offered me a ride in his Mercedes back to the city. And when I arrived, my man KC, the rickshaw driver, offered a friendly "wussup", and the guest house employees asked about the trip, and after Ace.

Most of all, I have oxygen. One never would have expected to enjoy the polluted, humid air of Kathmandu, but despite being at 1,337 m (4,380 feet), it is a full two miles below the aforementioned Ganden monastery and therefore offers a relative abundance of O2. I don't envy Ace who has to bed up at 4,500 m tonight, after a meal of Tibetan food.

Tibetan cuisine is, charitably, an acquired taste. The traditional staple consists of Tsampa, a barley meal, mixed with yak-butter tea and salt. Modern Tibetan food has some meat and vegetables, but is rather bland, leading most tourist-oriented restaurants to serve Nepali, Indian or Western food. Last night we had an awful meal which was highlighted by salty potato dumplings (momos) which were pretty much inedible. To make matters even more interesting, in Lhasa we refrained from enjoying icy cold beers with our meal, due to the altitude.

But today I can enjoy the KGH courtyard, surrounded by trekkers and NGO-types conducting meetings regarding development projects, and drink masala chai and plan my afternoon Tandoori meal.

Now, I'm ensconced in comfort at the Kathamandu Guest House, where I have Western newspapers, puri and bateta, and a quiet courtyard in which to enjoy these treasures. It was nice to arrive at the airport and unexpectedly meet our travel man Kul, who offered me a ride in his Mercedes back to the city. And when I arrived, my man KC, the rickshaw driver, offered a friendly "wussup", and the guest house employees asked about the trip, and after Ace.

Most of all, I have oxygen. One never would have expected to enjoy the polluted, humid air of Kathmandu, but despite being at 1,337 m (4,380 feet), it is a full two miles below the aforementioned Ganden monastery and therefore offers a relative abundance of O2. I don't envy Ace who has to bed up at 4,500 m tonight, after a meal of Tibetan food.

Tibetan cuisine is, charitably, an acquired taste. The traditional staple consists of Tsampa, a barley meal, mixed with yak-butter tea and salt. Modern Tibetan food has some meat and vegetables, but is rather bland, leading most tourist-oriented restaurants to serve Nepali, Indian or Western food. Last night we had an awful meal which was highlighted by salty potato dumplings (momos) which were pretty much inedible. To make matters even more interesting, in Lhasa we refrained from enjoying icy cold beers with our meal, due to the altitude.

But today I can enjoy the KGH courtyard, surrounded by trekkers and NGO-types conducting meetings regarding development projects, and drink masala chai and plan my afternoon Tandoori meal.

It took me about five minutes to figure out how to read our blogs from China, using certain web-based anonymous proxy servers.

Silicon Valley 1, ChiComs 0.

Silicon Valley 1, ChiComs 0.

So if I understand this correctly, I can post from here, but I can't actually read the blog. Which means I can't read Ace's blog, so I have no idea whether he is making any sense or not. Luckily, we have been here 24 hours now and appear to be acclimatized to the altitude, so his ramblings will probably make as much sense as they ever do.

Lhasa's, and Tibet's, greatest asset is its people. They smile easily and often, and exhibit a cheerfulness which is all the more remarkable given the ample reasons they have to be discouraged and bitter. Ace didn't notice one pilgrim who, smiling, stuck her tongue out at him. "Stick your tongue out!" I hissed at him. I had to explain that this was considered a mark of respect before the ChiComs told the Tibetans that the custom was backwards and to be discouraged. People from the smaller towns still practice the gesture, and it has been very entertaining to see older folk or even young children returning the greeting.

The highlight of the day's journey was sitting in on a ceremony performed by monks at the Sera Monastery, which consisted of a baritone-pitched repetition of murmured prayers and mantras, interspersed with ringing of little bells. To my untrained ear these prayers sounded novel, incomprehensible and fascinating. There is some sort of signal within the prayers which allows the "lead", if you will, to change from monk to monk. At times it sounds like they're all murmuring something different, when suddenly this low cacaphony will fuse into a rising unison. At other times, the youngest monks will quickly jump up from their seats and run out to fetch more butter tea for the older clergy. There we sat, under a canopy of tapestries, surrounded by Buddhas and burning yak-butter lamps, listening to a cloister of red-robed holy men reciting words that had filtered down through the millennia.

And then one exits the assembly hall and notices, beyond the gilded towers and colourful, fluttering prayer flags, the vista of a nearby peak, ensconced in a cloud suspended in the crystal blue sky. And one remembers reading that this country is almost the size of Western Europe, and certainly larger than France, Germany and Italy put together. And perhaps its the hypoxia, but you sort of wonder if this is all a dream, and how such a place could ever exist.

Lhasa's, and Tibet's, greatest asset is its people. They smile easily and often, and exhibit a cheerfulness which is all the more remarkable given the ample reasons they have to be discouraged and bitter. Ace didn't notice one pilgrim who, smiling, stuck her tongue out at him. "Stick your tongue out!" I hissed at him. I had to explain that this was considered a mark of respect before the ChiComs told the Tibetans that the custom was backwards and to be discouraged. People from the smaller towns still practice the gesture, and it has been very entertaining to see older folk or even young children returning the greeting.

The highlight of the day's journey was sitting in on a ceremony performed by monks at the Sera Monastery, which consisted of a baritone-pitched repetition of murmured prayers and mantras, interspersed with ringing of little bells. To my untrained ear these prayers sounded novel, incomprehensible and fascinating. There is some sort of signal within the prayers which allows the "lead", if you will, to change from monk to monk. At times it sounds like they're all murmuring something different, when suddenly this low cacaphony will fuse into a rising unison. At other times, the youngest monks will quickly jump up from their seats and run out to fetch more butter tea for the older clergy. There we sat, under a canopy of tapestries, surrounded by Buddhas and burning yak-butter lamps, listening to a cloister of red-robed holy men reciting words that had filtered down through the millennia.

And then one exits the assembly hall and notices, beyond the gilded towers and colourful, fluttering prayer flags, the vista of a nearby peak, ensconced in a cloud suspended in the crystal blue sky. And one remembers reading that this country is almost the size of Western Europe, and certainly larger than France, Germany and Italy put together. And perhaps its the hypoxia, but you sort of wonder if this is all a dream, and how such a place could ever exist.

. . . to your desktop

After a ninety minute flight which was highlighted by a majestic Everest peaking through the clouds to the west, we landed in Lhasa. I have just spent 250 pages absorbing the country as it was, as described by Heinrich Harrer in his epic account, but I was still wholly unprepared for what waited at Lhasa airport. Surrounded by magnificent hills and a few snow-capped peaks, with white puffy clouds hovering tantalizingly close in the clear, blue mountain air, I was awestruck.

On the 56 km road from the airport to the city, I found myself overcome with emotion. I'm not sure if this occurred due to the physical beauty or the knowledge of the tragic history of this land and its people.

Lhasa itself is a bit depressing. The roads are wide boulevards like you would find in any Eastern European city, such as Bucharest. They have names like "Beijing Avenue". The vast majority of architecture appears to date no older than perhaps twenty years. People's Republican Army representatives are present in every square, sitting in the middle on chairs reserved for them. One of these gentlemen shoved Ace out of the way as he was walking through the crowd, then paused to jostle a praying pilgrim, before continuing on his merry way.

We have each consumed at least three litres of water and have been carbo-loading in an effort to avoid acute mountain sickness. We are only at 3595 metres (11,800 feet), so we should be fine. The only time I suffered from this affliction was at around 14,000 feet, when Double Barrel and I were trudging up Rainier. In Lhasa, the worst that has happened is that we feel slightly stupider then our general equilibrium stupidity.

The people here are wonderful. Really friendly, genuine and cheerful. Some of them cannot get over seeing our non-traditional faces and will stop to stare openly at us. One fellow was shocked to see Ace's arm hair, and paused to touch it to make sure it was real.

I really hope this post makes it to your desktop; I'm not sure how good the internet connections are in lovely China.*

*It worked - excellent.

After a ninety minute flight which was highlighted by a majestic Everest peaking through the clouds to the west, we landed in Lhasa. I have just spent 250 pages absorbing the country as it was, as described by Heinrich Harrer in his epic account, but I was still wholly unprepared for what waited at Lhasa airport. Surrounded by magnificent hills and a few snow-capped peaks, with white puffy clouds hovering tantalizingly close in the clear, blue mountain air, I was awestruck.

On the 56 km road from the airport to the city, I found myself overcome with emotion. I'm not sure if this occurred due to the physical beauty or the knowledge of the tragic history of this land and its people.

Lhasa itself is a bit depressing. The roads are wide boulevards like you would find in any Eastern European city, such as Bucharest. They have names like "Beijing Avenue". The vast majority of architecture appears to date no older than perhaps twenty years. People's Republican Army representatives are present in every square, sitting in the middle on chairs reserved for them. One of these gentlemen shoved Ace out of the way as he was walking through the crowd, then paused to jostle a praying pilgrim, before continuing on his merry way.

We have each consumed at least three litres of water and have been carbo-loading in an effort to avoid acute mountain sickness. We are only at 3595 metres (11,800 feet), so we should be fine. The only time I suffered from this affliction was at around 14,000 feet, when Double Barrel and I were trudging up Rainier. In Lhasa, the worst that has happened is that we feel slightly stupider then our general equilibrium stupidity.

The people here are wonderful. Really friendly, genuine and cheerful. Some of them cannot get over seeing our non-traditional faces and will stop to stare openly at us. One fellow was shocked to see Ace's arm hair, and paused to touch it to make sure it was real.

I really hope this post makes it to your desktop; I'm not sure how good the internet connections are in lovely China.*

*It worked - excellent.

Observations:

- It is a truism that there is nothing more pathetic than an ageing hippy. Unless your name is "Keith" or "Mick", kindly cut your hair and make use of some soap.

- All you investment bankers, attorneys and software engineers who claim to work hard should see what life is like in Nepal as a labourer. The women who till the fields, or the men who haul dried goods on large bags strapped to their backs via their heads are real workers, unlike anything we know (thankfully) in the Western world.

- We listened to a wonderful band tonight, playing the greatest hits of Deep Purple, Bad Company, The Doors, Dire Straits, etc. Makes one reminisce about one's youth.

That last screed will probably ensure that I won't be able to access The Blog from the People's Republic. But I will try to continue posting through trickery, chicanery and wiles.

Tomorrow, we fly to Tibet.

More accurately, tomorrow we fly to a Tibet which is presently occupied by the Red Chinese. As this is my last travelblog from a free realm, I will use the opportunity to get a few things off my chest.

The People's Republic, in invading the country last century, managed to summarily upheave and destroy vast swaths of what used to be Tibet in a matter of thirty odd years. Chairman Mao, on his way to killing an estimated 70 million of his own people, found time to murder 1.2 million Tibetans. Those that were not victims of his purges or camps died of starvation due to policies of collectivization and central planning which led to brilliant ideas such as planting wheat at an elevation where it would not survive.

Heinrich Harrer, in his brilliant Seven Years In Tibet, notes how religion was intimately woven through every facet of life in this former theocracy. The Reds, of course, had no use for "the opiate of the masses", and so, during the Great Proletarian Cultural Revolution they destroyed 99% of the 6000 monasteries in the country, purged the aristocracy and the religious order, banned all traditions and cultures which evoked spirituality and burned or used as toilet paper countless priceless historical records. Lastly, they pursued a policy of heightened immigration of Han Chinese, in order to supplant the native Tibetan ethnic group.

Now, I don't subscribe to the lefty-hippy shibboleth that societies exist in a kind of static equilibrium where any change is undesirable or somehow "synthetic" in the pejorative sense. But a centrally-planned policy (1) from a government that does not meet even basic enlightenment criteria of sovereignty (2) which results in genocide (3) and an absence of rule of law (4) gives me a number of reasons to cry foul.

It is not often that the editorial standards of "Taken At The Flood" descend to polemic, but it's worth remembering that in China, our friends at Goldman Sachs, Citigroup, Hines Properties, et. al. are dealing with and subject to a government which continues to be run by murderers, brigands and tyrants who, in terms of scale at least, make Pol Pot, Stalin, Hitler and Saddam look like mere schoolyard bullies.

More accurately, tomorrow we fly to a Tibet which is presently occupied by the Red Chinese. As this is my last travelblog from a free realm, I will use the opportunity to get a few things off my chest.

The People's Republic, in invading the country last century, managed to summarily upheave and destroy vast swaths of what used to be Tibet in a matter of thirty odd years. Chairman Mao, on his way to killing an estimated 70 million of his own people, found time to murder 1.2 million Tibetans. Those that were not victims of his purges or camps died of starvation due to policies of collectivization and central planning which led to brilliant ideas such as planting wheat at an elevation where it would not survive.

Heinrich Harrer, in his brilliant Seven Years In Tibet, notes how religion was intimately woven through every facet of life in this former theocracy. The Reds, of course, had no use for "the opiate of the masses", and so, during the Great Proletarian Cultural Revolution they destroyed 99% of the 6000 monasteries in the country, purged the aristocracy and the religious order, banned all traditions and cultures which evoked spirituality and burned or used as toilet paper countless priceless historical records. Lastly, they pursued a policy of heightened immigration of Han Chinese, in order to supplant the native Tibetan ethnic group.

Now, I don't subscribe to the lefty-hippy shibboleth that societies exist in a kind of static equilibrium where any change is undesirable or somehow "synthetic" in the pejorative sense. But a centrally-planned policy (1) from a government that does not meet even basic enlightenment criteria of sovereignty (2) which results in genocide (3) and an absence of rule of law (4) gives me a number of reasons to cry foul.

It is not often that the editorial standards of "Taken At The Flood" descend to polemic, but it's worth remembering that in China, our friends at Goldman Sachs, Citigroup, Hines Properties, et. al. are dealing with and subject to a government which continues to be run by murderers, brigands and tyrants who, in terms of scale at least, make Pol Pot, Stalin, Hitler and Saddam look like mere schoolyard bullies.

I'm exhausted today, due to a yoga class that was tough as hell. The teacher has a very binary viewpoint on the art: either you can do it, or you cannot. He will ask "have you done yoga before?" and if you answer in the affirmative, he will take you through a series of manoeuvres that would make an expert crumble. Also, this is about the time you notice that Kathmandu is at an altitude of 4500 feet.

So if you want a detailed account of the days events, I shall refer you to my indolent colleague, who prefers to spend the majority of his waking hours sleeping.

People who travel to Nepal in particular, or the Himalayas in general, are typically in search of something in their lives. As countless souls before me, I have been reflecting on life in general, and have come to a few potentially destiny-changing decisions:

1) I am going to buy a barbecue. When describing my apartment to Ace, I mentioned my balcony which overlooks the Bosporus, and he immediately said "dude - barbecue!" A brilliant idea. I will be making mishkaki (East African/Indian spicy barbecued meat) two weeks from now.

2) I am going to start a band. The quality of singing in this town has been so abysmal that I'm convinced I could do a better job. My buddy Tunç Bey is presently forming a band in Istanbul, and I know he needs a bassist, but I'm thinking they may also need a competent frontman. Ace asked "can you write music?" and I replied, "How hard can it be?" I mean, I have a couple of years of formal musical training (Mr. Hooper's grade 7 and 8 classes), whereas Paul McCartney couldn't read music when he wrote "Yesterday" at the age of twenty-one.

My one question is what the band´s name should be, hence the "bleg". (Blog + beg = bleg).

I had assumed I was going to call my band "The Competitive Sluts" (for reasons that are too complicated to get into, especially in a family blog) but Ace thought this would be inappropriate for gentlemen. He suggested "Electric Mariachi", which is decent. I have always been partial to Mariachi music and consider it one of my duties as Best Man to hire such a band for his wedding, without ZMama or any of her family (or Ace's family, for that matter) getting wind of my scheme.

But I've decided to put it out to the readership of "Taken At The Flood" to suggest a name for my forthcoming band. Please respond in the comment field.

"Follow your dreams, the sky's the limit! Don't let anybody hold you back!"

This was Ace, after a beer or two, discussing ambition with a well-dressed local young businessman with whom we were enjoying a quiet drink in a secluded bar.

Earlier, we had enjoyed listening to a local band on a lively rooftop bar, whose singer was neither attractive nor talented. Still, she tried.

Earlier still, we sat on cushions at a low table in a room adorned with mahogany and sandalwood filigree, where we enjoyed boti kebab and tandoori chicken with a little Patak's Lime Pickle on the side. "It is most pleasurable with nan or rice," commented our cordial Indian waiter.

Life is fine.

This was Ace, after a beer or two, discussing ambition with a well-dressed local young businessman with whom we were enjoying a quiet drink in a secluded bar.

Earlier, we had enjoyed listening to a local band on a lively rooftop bar, whose singer was neither attractive nor talented. Still, she tried.

Earlier still, we sat on cushions at a low table in a room adorned with mahogany and sandalwood filigree, where we enjoyed boti kebab and tandoori chicken with a little Patak's Lime Pickle on the side. "It is most pleasurable with nan or rice," commented our cordial Indian waiter.

Life is fine.

"An army travels on its stomach."

- Attribution unclear, perhaps Napoleon.

"And so do I."

- Sunset Shazz

Yesterday, after a day exploring Pashupatinath, the most important Hindu temple in Nepal, Ace and I had a powerful hunger in the evening. Our travel agent had recommended a Nepali restaurant, which turned out to be a sort of diner where the locals hung out and consumed large portions of food. Presently, we were given large thalis filled with rice, vegetable curry, mutton curry, various pickles and chilis. I efficiently put away this little repast, then ordered more of the delicious mutton, to our waiter's surprise and Ace's amusement. He reminded me of the story Faceman always likes to tell, about the time, after a huge meal that had left my friends exhausted, I continued eating and finished the last two lamb chops, with the rest of our dinner party looking on in astonishment, wondering where it all went. When the bill arrived with "extra mutton" tacked on at the bottom, Ace thought this was a hilarious statement about my basic life philosophy. I'm all about the extra mutton.

This morning, we couldn't figure out where we would breakfast, when in an inspired moment I thought of puris and potato curry. It turns out that this breakfast delicacy was readily available at the excellent restaurant garden at our guest house. Ace and I are connoisseurs, and we found both the puris (fried Indian crepes made with unleavened bread) and batetas to be superb. After a hike of several kilometres to the famous Monkey Temple and back through the tiny streets of the capital, we found a little hole-in-the-wall place which is famous for its dosas. I hadn't had a decent Masala Dosa since I was on Gerard st. in Toronto, so this was a welcome treat.

As for the actual things we saw and did? You can read Ace's account which is likely to be more factually detailed than my own.

- Attribution unclear, perhaps Napoleon.

"And so do I."

- Sunset Shazz

Yesterday, after a day exploring Pashupatinath, the most important Hindu temple in Nepal, Ace and I had a powerful hunger in the evening. Our travel agent had recommended a Nepali restaurant, which turned out to be a sort of diner where the locals hung out and consumed large portions of food. Presently, we were given large thalis filled with rice, vegetable curry, mutton curry, various pickles and chilis. I efficiently put away this little repast, then ordered more of the delicious mutton, to our waiter's surprise and Ace's amusement. He reminded me of the story Faceman always likes to tell, about the time, after a huge meal that had left my friends exhausted, I continued eating and finished the last two lamb chops, with the rest of our dinner party looking on in astonishment, wondering where it all went. When the bill arrived with "extra mutton" tacked on at the bottom, Ace thought this was a hilarious statement about my basic life philosophy. I'm all about the extra mutton.

This morning, we couldn't figure out where we would breakfast, when in an inspired moment I thought of puris and potato curry. It turns out that this breakfast delicacy was readily available at the excellent restaurant garden at our guest house. Ace and I are connoisseurs, and we found both the puris (fried Indian crepes made with unleavened bread) and batetas to be superb. After a hike of several kilometres to the famous Monkey Temple and back through the tiny streets of the capital, we found a little hole-in-the-wall place which is famous for its dosas. I hadn't had a decent Masala Dosa since I was on Gerard st. in Toronto, so this was a welcome treat.

As for the actual things we saw and did? You can read Ace's account which is likely to be more factually detailed than my own.

This morning, I awoke and went to yoga class.

Now this was a little weird - we meditated, did some dancing, some aerobics style jumping about, some typical asanas, but it was unlike any other yoga class I have ever experienced.

Typical quotes:

"Listen inwards. Think 'who am I'? Find the answer within yourself."

"Turn your attention towards the universe. Feel the cosmos."

Shortly after class was finished, Ace arrived, and we enjoyed a leisurely lunch, catching up. Then, we walked through the city, watching the old men reading newspapers, merchants sitting on the pavement selling produce, children playing in the streets, roosters, hens, cows. At one point, Ace was trying to tell me something from the guidebook, but I completely ignored him, watching, fascinated, a woman who was squatting on the sidewalk, braiding her daughter's hair, while her infant child burbled on her back.

We have some great pictures from this walk, which I hope to post later, including one which Ace managed to swiftly take. I had sat down in the middle of a square, and said hi to a little boy, no more than 4 years old, who was playing ball. This little fellow decided he would sit beside me and have a quiet chat for a bit. He was so small, he struggled to sit upon the low stone bench, but once he was up there, he just beamed, content.

This evening before dinner we spent a few hours negotiating the purchase of entry into Tibet. Hopefully, we shall find our way there without mishap.

To assuage our families' fears: all is quiet and serene in Kathmandu. Please don't worry.

After an uneventful evening on the Persian Gulf, in Doha, I finally made it to Kathmandu this afternoon.

My father seems to suffer from the misapprehension that Istanbul is an Asian city. He's out of his mind. Istanbul is very clearly European, a fact that forms a precise relief when one actually walks through a truly Asian city.

Kathmandu is a small capital, dotted by low-lying burgundy-brick buildings which slouch, in varying states of disrepair, on either side of narrow streets. I am staying at the Kathmandu Guest House, a legendary spot amongst budget travellers, which was highly recommended by a friend in Istanbul. This pleasing compound is built around a series of courtyards and gardens, which provides for a peaceful, somewhat bucolic ambience amidst the fumes and bustle of the city.

As I always do when I first arrive somewhere, I wandered through the city, attempting to absorb the vibe. On one corner, quite a few guys were sitting against a low wall, just generally watching life pass by. Seemed like a profitable enterprise, so I joined them. Pretty good entertainment watching the multitude of pedestrians, scooters and automobiles careening their way through the slender street. Although there are far fewer cars here than in Istanbul, they (if this is at all possible) try and honk their horns even more than at home. All in all, I still believe the Turks are worse at driving.

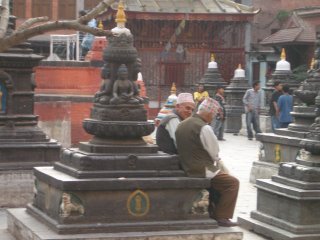

Presently, I happened upon a little square with a temple in the centre. Here there seemed to be a bunch of locals hanging out, discussing the events of the day, preparing for their evenings. I joined them, sitting on a concrete bench, and had a peaceful time until I pulled out my camera. Immediately, I was surrounded by a bunch of the local kids, with whom I had some entertaining discussions.

Fortunately for me, I come from an ethnic persuasion which is known for its recalcitrance when it comes to spending money. As a consequence, beggars, touts and troublemakers tend to give me little attention. These kids never once asked me for money. We just chatted of this and that, exchanged business cards - the usual. One young girl immediately guessed my religion and ethnicity from my Christian name; she and I began speaking broken Hindhi to each other once she determined I was Indian.

This evening I had a hearty Indian meal; my dhaal makhni had enough ghee (Indian clarified butter) to give my old physician Dr. Pudberry hysterics. Traditional Nepali food is bland (presumably due to the fact that a higher elevation invites less of a need for the antibacterial and masking properties of spice). But the Kathmandu region has tons of spicy Indian food, for which I am extremely grateful. I was quite tempted to try some of the enticing pickle served with the meal, but I abstained due to Dr. Diamond's strict instructions. One of my main goals on this trip is to maintain a healthy palour and a strong stomach.

Tomorrow, Ace arrives, which should make things interesting.

Missing you all,

Sunset Shazz

My father seems to suffer from the misapprehension that Istanbul is an Asian city. He's out of his mind. Istanbul is very clearly European, a fact that forms a precise relief when one actually walks through a truly Asian city.

Kathmandu is a small capital, dotted by low-lying burgundy-brick buildings which slouch, in varying states of disrepair, on either side of narrow streets. I am staying at the Kathmandu Guest House, a legendary spot amongst budget travellers, which was highly recommended by a friend in Istanbul. This pleasing compound is built around a series of courtyards and gardens, which provides for a peaceful, somewhat bucolic ambience amidst the fumes and bustle of the city.

As I always do when I first arrive somewhere, I wandered through the city, attempting to absorb the vibe. On one corner, quite a few guys were sitting against a low wall, just generally watching life pass by. Seemed like a profitable enterprise, so I joined them. Pretty good entertainment watching the multitude of pedestrians, scooters and automobiles careening their way through the slender street. Although there are far fewer cars here than in Istanbul, they (if this is at all possible) try and honk their horns even more than at home. All in all, I still believe the Turks are worse at driving.

Presently, I happened upon a little square with a temple in the centre. Here there seemed to be a bunch of locals hanging out, discussing the events of the day, preparing for their evenings. I joined them, sitting on a concrete bench, and had a peaceful time until I pulled out my camera. Immediately, I was surrounded by a bunch of the local kids, with whom I had some entertaining discussions.

Fortunately for me, I come from an ethnic persuasion which is known for its recalcitrance when it comes to spending money. As a consequence, beggars, touts and troublemakers tend to give me little attention. These kids never once asked me for money. We just chatted of this and that, exchanged business cards - the usual. One young girl immediately guessed my religion and ethnicity from my Christian name; she and I began speaking broken Hindhi to each other once she determined I was Indian.

This evening I had a hearty Indian meal; my dhaal makhni had enough ghee (Indian clarified butter) to give my old physician Dr. Pudberry hysterics. Traditional Nepali food is bland (presumably due to the fact that a higher elevation invites less of a need for the antibacterial and masking properties of spice). But the Kathmandu region has tons of spicy Indian food, for which I am extremely grateful. I was quite tempted to try some of the enticing pickle served with the meal, but I abstained due to Dr. Diamond's strict instructions. One of my main goals on this trip is to maintain a healthy palour and a strong stomach.

Tomorrow, Ace arrives, which should make things interesting.

Missing you all,

Sunset Shazz

Before I leave on any trip, it is my tradition, when planning the immediate future, to examine the present and the recent past.

Specifically, I like to think of my last trip. I had not posted a detailed account of the journey to Italy principally because it would have read like the journal of a very fat person. Also, this was the trip where Ace proposed to ZMama, and I was told to embargo the information for at least a few weeks, until it was disseminated through proper channels.

Here is a typical scene from that trip:

After saying bye to Semirabai, who had to get back Stateside for her job (can't remember what that was like), we hopped on the autostrade to Parma, a city I've passed through many times, which has one of my favourite restaurants in the world. There, we sat for an hour-long sumptuous three course lunch, washed down by a little lambrusco rosso.

That night we arrived in Bologna, figured out where we would stay, then sat at a bar and watched the Canadian hockey team get eliminated from the tournament. The next afternoon we found a little trattoria where the waitress brought the wine, water and bread, and we had a leisurely wait for the first course. Presently, this arrived: an enormous spaghetti bolognaise (in Bologna they call it ragu, just like in China they call Chinese food "food"). I thought to myself, "there's no way I'm gonna finish this and still have the second course". But after blinking a couple of times, suddenly the food was gone and I was aching for the next chapter. The veal arrived, delicately sauteed in lemon and white wine, and I polished it off in short order. After dessert, coffee, and some ice cream, all was well with the world.

So that was Italy.

Specifically, I like to think of my last trip. I had not posted a detailed account of the journey to Italy principally because it would have read like the journal of a very fat person. Also, this was the trip where Ace proposed to ZMama, and I was told to embargo the information for at least a few weeks, until it was disseminated through proper channels.

Here is a typical scene from that trip:

After saying bye to Semirabai, who had to get back Stateside for her job (can't remember what that was like), we hopped on the autostrade to Parma, a city I've passed through many times, which has one of my favourite restaurants in the world. There, we sat for an hour-long sumptuous three course lunch, washed down by a little lambrusco rosso.

That night we arrived in Bologna, figured out where we would stay, then sat at a bar and watched the Canadian hockey team get eliminated from the tournament. The next afternoon we found a little trattoria where the waitress brought the wine, water and bread, and we had a leisurely wait for the first course. Presently, this arrived: an enormous spaghetti bolognaise (in Bologna they call it ragu, just like in China they call Chinese food "food"). I thought to myself, "there's no way I'm gonna finish this and still have the second course". But after blinking a couple of times, suddenly the food was gone and I was aching for the next chapter. The veal arrived, delicately sauteed in lemon and white wine, and I polished it off in short order. After dessert, coffee, and some ice cream, all was well with the world.

So that was Italy.

Stendhal loved Parma, and so do I.

I have posted an old story, for reasons which will become clear below.

Three nights ago, I was out with my Yoga teacher, who, unlike the majority of yoga teachers, is not averse to a cocktail or two. Her view (quite rightly) is that acetism has its utility, but is best practiced by people other than one's self. Sitting in a quiet café in the Asmalı Mescit district, chatting with a girl who lives in Goa, I was unexpectedly approached by Eren, who is a friend of my pal Eda from San Francisco. Last October we memorably arranged to meet at a Halloween bash.

Yesterday afternoon, after an exhausting day of doing nothing, my friend Sue and I were having a glass of wine at a café terrace, when I was introduced by the owner to a guy from San Francisco, who immediately said "Shazz, what's up, how you been?"

Turns out he is also a friend of Eda's who was one of the organizers of the Halloween party.

This is a small town, but I thought it was a bit odd that I met both these people (two of maybe 5 contacts I had in this city prior to moving) over the last three nights.

Three nights ago, I was out with my Yoga teacher, who, unlike the majority of yoga teachers, is not averse to a cocktail or two. Her view (quite rightly) is that acetism has its utility, but is best practiced by people other than one's self. Sitting in a quiet café in the Asmalı Mescit district, chatting with a girl who lives in Goa, I was unexpectedly approached by Eren, who is a friend of my pal Eda from San Francisco. Last October we memorably arranged to meet at a Halloween bash.

Yesterday afternoon, after an exhausting day of doing nothing, my friend Sue and I were having a glass of wine at a café terrace, when I was introduced by the owner to a guy from San Francisco, who immediately said "Shazz, what's up, how you been?"

Turns out he is also a friend of Eda's who was one of the organizers of the Halloween party.

This is a small town, but I thought it was a bit odd that I met both these people (two of maybe 5 contacts I had in this city prior to moving) over the last three nights.

I know you will scarcely find this credible, but until about 5 minutes ago, I hadn't yet gotten excited about my trip to Nepal. When I was a kid, I would anticipate vacations months ahead of time, and spend hours working myself into a lather about where I would go and what I would do. Over the intervening years, I've developed a sort of ability to focus more sedulously on tasks at hand - age quod agis. I expect this happened due to the fact that as an adult I was travelling so frequently (both professionally and for leisure) that a more disciplined frame of mind was needed just to maintain some semblance of order.

Anyway, I've been focusing on things like my trip to Bodrum and my Turkish classes, rather than this upcoming trip. But a few minutes ago, over MSN Instant Messenger, we quickly formed a plan.

Ace and I are reasonably well-travelled (he much more so than I), so we had no problem deciding weeks ago that we would show up and wing it from there. Today, my friend Sue got me a Lonely Planet: Nepal which finally allowed me to do some cursory research. Additionally, it was a bright, sunny day in Istanbul, which resulted in my sitting outside at a café terrace and enjoying a leisurely, reflective lunch. This particular café is owned by a lady from San Francisco who has travelled several times to Kathmandu, and knows it pretty well. She lunched with me and gave me somewhat of an inside scoop.

Then, Ace IM'd, wondering how we were going to meet up - it's like the days before cellphones.

Well, we've done this before. Years ago, we arranged to meet at the Grasshopper coffeeshop in Amsterdam. Only, we had not been informed that this fine establishment has three locations scattered through the city. What a great time that was, walking from place to place, trying to find Ace, not knowing that he had broken up with his girlfriend and fled to Belgium, and was presently attempting to rid the country of beer by drinking it all. We did later manage to meet up at the Hôtel de Ville in Paris, so everything worked itself out in the end.

So now I've arranged with Ace a plan, as well as a contingency plan, because we are intimately acquainted with Murphy's Law. And I immediately thought of the last time we had to make such a plan, which was almost twelve years ago, and how much fun we had then.

This is going to be damn cool.

Anyway, I've been focusing on things like my trip to Bodrum and my Turkish classes, rather than this upcoming trip. But a few minutes ago, over MSN Instant Messenger, we quickly formed a plan.

Ace and I are reasonably well-travelled (he much more so than I), so we had no problem deciding weeks ago that we would show up and wing it from there. Today, my friend Sue got me a Lonely Planet: Nepal which finally allowed me to do some cursory research. Additionally, it was a bright, sunny day in Istanbul, which resulted in my sitting outside at a café terrace and enjoying a leisurely, reflective lunch. This particular café is owned by a lady from San Francisco who has travelled several times to Kathmandu, and knows it pretty well. She lunched with me and gave me somewhat of an inside scoop.

Then, Ace IM'd, wondering how we were going to meet up - it's like the days before cellphones.

Well, we've done this before. Years ago, we arranged to meet at the Grasshopper coffeeshop in Amsterdam. Only, we had not been informed that this fine establishment has three locations scattered through the city. What a great time that was, walking from place to place, trying to find Ace, not knowing that he had broken up with his girlfriend and fled to Belgium, and was presently attempting to rid the country of beer by drinking it all. We did later manage to meet up at the Hôtel de Ville in Paris, so everything worked itself out in the end.

So now I've arranged with Ace a plan, as well as a contingency plan, because we are intimately acquainted with Murphy's Law. And I immediately thought of the last time we had to make such a plan, which was almost twelve years ago, and how much fun we had then.

This is going to be damn cool.

My buddy Ace has, to his parents' consternation, decided to visit Nepal and Tibet on his last major trip before he starts his high-powered career in Silicon Valley (involving moving, shaking and breakfasts with VCs at Il Fornaio).

To my own parents' consternation, I have decided to join him.

So I shall be leaving the city for about 10 days, returning just a day after The Double Barrel arrives in town from Cali. Double B is in for a merry ride, given that his constitution will be geared towards marathon training, rather than Turkish city living.

I shall do my very best to travelblog from Nepal, but I'm not sure how reliable internet access will prove to be.

In the mean time, here's a picture from Gündoğan, on the Bodrum penninsula:

To my own parents' consternation, I have decided to join him.

So I shall be leaving the city for about 10 days, returning just a day after The Double Barrel arrives in town from Cali. Double B is in for a merry ride, given that his constitution will be geared towards marathon training, rather than Turkish city living.

I shall do my very best to travelblog from Nepal, but I'm not sure how reliable internet access will prove to be.

In the mean time, here's a picture from Gündoğan, on the Bodrum penninsula:

“Wadda ya wanna know about it?” asked my Vegas cabbie, careening under the hot desert sun from McCarran International Airport to The Venetian.

It was July 2002, and I was in town for my buddy Faceman’s now-legendary bachelor party.* I had just asked the driver about the prospects for the site of the old Desert Inn, a once-great casino-hotel built by the inimitable Howard Hughes. The hotel had been demolished by the new landowner, Wharton alumnus Steve Wynn, with his customary audacity - barely a month after the September 2001 terrorist attacks.

“Tell me all about it, what’s Wynn thinking of doing?”

“Well, of course,” began the cabbie in the flat vowels which betrayed a thick Midwestern accent, “Wynn is a real player. He built the 3000-room Bellagio for $1.6 billion, although some $350 million of that was for the art in the gallery.** When he sold out to MGM mirage, he cashed out about $700 million after taxes. So now he’s got a little bankroll to play with.”

“Right, so what’s next, eh?”

“Oh, this guy has balls!” gestured the cabbie, swerving to avoid a clueless tourist. “He puts together the deal of a lifetime – a real Kirk Kerkorian deal! He throws the whole chunk of change in the pot - buys the DI and the DI golf course, with all its land. So now he’s all in. But he needs to get a few of his chips back, cause he still hasn’t built his casino!”

One of the cool things about Vegas is that cab drivers, when discussing real estate deals, will invariably use poker metaphors.

“So it takes him almost two years, but he finally lines up some equity financing, from these Japanese guys. And get this – he gets them to put up like $600 million for 49.9% of the deal! He takes almost all of his chips off the table, and still maintains control! And now he’s gonna get Wall Street to finance the sticks and bricks. Unbelievable! What a guy!”

At this point, the cabbie got really excited, and we started talking about the plans for what would eventually open in May 2005 as the Wynn Las Vegas.

I only bring this up because, to a greater extent in Vegas, but also to a lesser extent in other locales, cabdrivers tend to be experts in land economics. The average Las Vegas cabdriver knows as much about real estate development as the typical contestant on “The Apprentice”. Occupancy rates, building costs, partnership control arrangements – ask your cabbie next time you’re in Sin City, he’ll know the answer.

Today I am in Bodrum and my Turkish is far enough along that I can talk basic economics with my cabbie. Absolutely critical from a due diligence perspective.

*At which nothing happened. Nothing.

**All numbers in this post are estimates, because unfortunately – disastrously – that notebook was lost during an all-nighter at Binion’s Horseshoe.

It was July 2002, and I was in town for my buddy Faceman’s now-legendary bachelor party.* I had just asked the driver about the prospects for the site of the old Desert Inn, a once-great casino-hotel built by the inimitable Howard Hughes. The hotel had been demolished by the new landowner, Wharton alumnus Steve Wynn, with his customary audacity - barely a month after the September 2001 terrorist attacks.

“Tell me all about it, what’s Wynn thinking of doing?”

“Well, of course,” began the cabbie in the flat vowels which betrayed a thick Midwestern accent, “Wynn is a real player. He built the 3000-room Bellagio for $1.6 billion, although some $350 million of that was for the art in the gallery.** When he sold out to MGM mirage, he cashed out about $700 million after taxes. So now he’s got a little bankroll to play with.”

“Right, so what’s next, eh?”

“Oh, this guy has balls!” gestured the cabbie, swerving to avoid a clueless tourist. “He puts together the deal of a lifetime – a real Kirk Kerkorian deal! He throws the whole chunk of change in the pot - buys the DI and the DI golf course, with all its land. So now he’s all in. But he needs to get a few of his chips back, cause he still hasn’t built his casino!”

One of the cool things about Vegas is that cab drivers, when discussing real estate deals, will invariably use poker metaphors.

“So it takes him almost two years, but he finally lines up some equity financing, from these Japanese guys. And get this – he gets them to put up like $600 million for 49.9% of the deal! He takes almost all of his chips off the table, and still maintains control! And now he’s gonna get Wall Street to finance the sticks and bricks. Unbelievable! What a guy!”

At this point, the cabbie got really excited, and we started talking about the plans for what would eventually open in May 2005 as the Wynn Las Vegas.

I only bring this up because, to a greater extent in Vegas, but also to a lesser extent in other locales, cabdrivers tend to be experts in land economics. The average Las Vegas cabdriver knows as much about real estate development as the typical contestant on “The Apprentice”. Occupancy rates, building costs, partnership control arrangements – ask your cabbie next time you’re in Sin City, he’ll know the answer.

Today I am in Bodrum and my Turkish is far enough along that I can talk basic economics with my cabbie. Absolutely critical from a due diligence perspective.

*At which nothing happened. Nothing.

**All numbers in this post are estimates, because unfortunately – disastrously – that notebook was lost during an all-nighter at Binion’s Horseshoe.

This weekend was so much fun, I honestly am having some of the best days of my life here. I got to see Gina, one of my favourite people in the world, and managed to have a couple of raging nights. An action-packed weekend, with several memorable events. In no particular order:

- Went out with a friend to 607, a spectacular bar in my neighourhood, where the view is stunning and the bartender makes a competent dry martini. A fellow at the bar, a little misty-eyed, commented how proud it makes him feel to hear us speak Turkish. The bar was quiet when we arrived, but eventually the dance floor got a bit going, and when "Don't stop 'til you get enough" came on, I pulled out the Michael Jackson high kick, à la Donny Mac. Yeeeeah.

- Went for a run in Maçka Park, and noticed how hilly Istanbul is; comparable to San Francisco. By the way, I think I'm in the worst shape of my life, presently.

- Table-dancing at Cezayir. At this Beyoğlu bar, my friends were up on the tables, shaking it, and I was able to practice my Turkish because one dude spoke no English. Also, I ran into various people from the neighborhood, one of whom I had met just a few days previously. That place feels like someone's living room.

- Sumptuous meal at Mikla, admiring the gorgeous view and the excellent food. Istanbul really has some fine dining.

- Having a quiet dinner in Nevizade Sokak, a street that is filled with restaurants and bars, while a particularly important soccer match was being played, keeping people off the streets. We later went to The Hidden Bar, an establishment which is on the first floor of a non-descript building, and is one of those places which, unless one knows about it, is impossible to find. The chillest bar in the city.

- Stayed up until 5:30 AM listening to the Senators suffer a 7-6 loss which featured four goals in the last 1.5 minutes.

My old college roommate is in town from Ankara, for a little fun in the city before she moves to Kosovo. We were discussing how odd it is that many of our circle are scattering all over the globe. EnduranceJay is likely moving to Shanghai. Ace reports that in the near future he may be stationed in India. I told Double-B to get with the program and move to Estonia or Brazil, perhaps.

Last night after dinner we were chilling at Cezayir, a local bar, and met up with some friends of friends. There was myself, Gina and her co-worker who is from Ottawa - obviously three anglophones. One of the guys we met up with lives in Connecticut, so his English was decent, but the other spoke not a word. So this was excellent - I got a chance to practice my Turkish after having downed a few drinks. The last time I tried this I was completely incapable of speech, so over the last few weeks I think I've made some small progress.

Last night after dinner we were chilling at Cezayir, a local bar, and met up with some friends of friends. There was myself, Gina and her co-worker who is from Ottawa - obviously three anglophones. One of the guys we met up with lives in Connecticut, so his English was decent, but the other spoke not a word. So this was excellent - I got a chance to practice my Turkish after having downed a few drinks. The last time I tried this I was completely incapable of speech, so over the last few weeks I think I've made some small progress.

Q: Why does Michael Jackson like twenty-five-year-old boys?

A: Because there are twenty of them.

I managed to tell this joke in Turkish today in class, which was quite a feat. Humour is extremely difficult to master in another language. As an example, I speak French pretty much fluently, but could never manage to tell a joke that would please the Gallic funnybone. I suppose this is primarily due to the fact that the French believe that Jerry Lewis and people with red plastic noses are the pinnacle of human comedy. French famously has no proper word which is the equivalent of "humour". They are literally humourless.

Anyway, the joke I actually wanted to tell, but was unable to, is the following, contributed by Ace:

Q: What is the difference between a Ukrainian woman and a catfish?

A: One stinks and has whiskers, and the other is a fish.

Badoom-cha!

A: Because there are twenty of them.

I managed to tell this joke in Turkish today in class, which was quite a feat. Humour is extremely difficult to master in another language. As an example, I speak French pretty much fluently, but could never manage to tell a joke that would please the Gallic funnybone. I suppose this is primarily due to the fact that the French believe that Jerry Lewis and people with red plastic noses are the pinnacle of human comedy. French famously has no proper word which is the equivalent of "humour". They are literally humourless.

Anyway, the joke I actually wanted to tell, but was unable to, is the following, contributed by Ace:

Q: What is the difference between a Ukrainian woman and a catfish?

A: One stinks and has whiskers, and the other is a fish.

Badoom-cha!

About me

- I'm Sunset Shazz

- Living the dream in Istanbul, Türkiye

- I grew up in the hardscrabble streets of suburban Ottawa, Ontario, committing petty crime, insulting the elderly - basically the classic misspent youth. When I was 19, I moved to West Philly, where I put myself through the Wharton School by dealing crack and hustling. After stints in Paris and London, I eventually graduated and moved to San Francisco, where I put in eight years hard labor working for The Man. But now I pop bottles with models, deciding cracked crab or lobster - who says mobsters don't prosper?

More information about this blog. - My profile